The Moving Average Generates Sell Signals

On the left side of the chart going back one year you can see the stock pulled back in late July but rather than freefalling Labcorp found support at its 200-day moving average. The moving average generates sell signals A.

How To Use Moving Averages For Stock Trading Youtube

The formula for calculating Simple Moving Average is.

. Any type of moving average can be used to generate buy or sell signals and this process is very simple. Signals are generated in places where prices intersect these lines. Sell signals are generated the same way as the buy ones If 30 day EMA crosses the 60 Day and 120 Day EMA from below and moves above them its the first confirmation of a sell signal.

The moving average generates sell signals A. The buysell can be generated as below condition satisfy. 15 28 89 etc.

When the short term moving average crosses above the long term moving average this indicates a buy signal. An exponential moving average of MACD is used as a signal line to indicate the upward or downward momentum. The moving average generates sell signals _____.

On days 7 15 and 18 C. On days 2 and 16 C. The moving average smooths out individual highs and lows in.

On the next two tests the price marginally drops below the. On no days 11. A moving average can be any length.

The 25 price might now be considered the _____. Moving Average Crossover Trading Strategy with Python A Python script to generate buysell signals using Simple moving average SMA and Exponential moving average EMA Crossover Strategy. There is no perfect or ideal way to use moving average lines nor an ideal timeframe used in their calculation.

On days 5 9 and 13 D. As the price starts its uptrend it tests the 100-day moving average but quickly starts to rise off of it which generates a buy signal. 2 Medium Learning Objective.

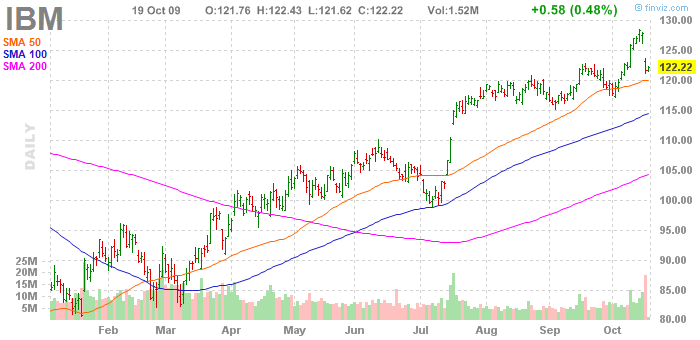

B uy and sell signals can be generated by two moving averages a long-period and a short-period average. Using Moving Averages for Buy and Sell Signals We use the 200-day exponential moving average to determine buy and sell points for various ETFs. When the short term moving average crosses below the long term moving average indicates.

The price of a stock fluctuates over a period of 10 days. Economy or even the global economy C. The moving average generates sell signals A.

Moving averages can be used in a number of ways and with a variety of timeframes. The moving averages are as follows. The movement of the stock price below the 10-day minimum price of 25 triggers a rash of selling.

On day 16 The moving average generates buy signals A. On day 16 B B. In the MA crossover strategy we draw 2 or 3 moving averages- lower moving average and higher moving average in the technical chart.

On days 3 11 and 15 B. The movement of the stock price below the 10 day minimum price of 25 triggers a rash of selling. Many traders use multiple moving averages each with a different timeframe to generate buy and sell signals.

The movement of the stock price below the 10 day minimum price of 25 triggers a rash of selling. Technical Analysis and Behavioral Finance 83. 09-03 Identify reasons why technical analysis may be profitable.

On days 5 9 and 13 D. On days 3 11 and 15 B. A top down analysis of a firms prospects starts with an analysis of the A.

On days 7 15 and 18. The moving average generates buy signals. Prices with 5 day moving average ine 20 18 10 12 10 27 The moving average generates sell signals B on days 3 11 and 15 D on days 7 15 and 18 A on days 59 and 13 C on day 16.

VWAP is only calculated per day but MVWAP c. Likewise many investment professionals have adopted. On days 7 15 and 18 C.

On days 59 and 13 D. The Simple Moving Average is the most popular technical analysis tool that is used by traders. Simple Moving Average SMA P1 P2 P3No of periods.

The moving average is an indicator that follows the price with a lag meaning that it generates a signal after the trend has changed. Specific firm under consideration 12. The 25 price might now be.

On days 5 9 and 13 D. On days 5 9 and 13 D. If the time frame referenced.

On days 5 9 and 13 D. When the short moving average rises or falls below the long moving average buy or sell. On days 5 9 and 13 D.

The movement of the. On days 3 11 and 15 B. The charting software plots the moving average as a line directly into the price chart.

On days 3 11 and 15 B. On day 16 AACSB. On days 7 15 and 18 C.

Firms position in its industry B. Moving Volume Weighted Average Price MVWAP For ThinkOrSwimAn MVWAP is basically an average of the VWAP values. An exponential moving average is nothing but simply a moving average that gives more weightage to the recent data.

The price of a stock fluctuates over a period of 10 days. The price of a stock fluctuates over a period of 10 days. On days 3 11 and 15 B.

On days 7 15 and 18 Difficulty. The second confirmation signal for sell is generated if the RSI moves above the overbought line that is the red line of 70. On days 7 15 and 18 C.

Adjusting the moving average so it provides more accurate signals on historical data may help create better future signals. On days 2 8 and 16 C. The Simple Moving Average SMA is used for identifying trend direction and can also be used for generating potential buy and sell signals.

A on days 3 11 and 15 B. On days 3 11 and 15 B. On no days The price of a stock fluctuates between 43 and 60.

If the lower moving average crosses the higher moving average from below and the stock closing price is above both the moving average we can consider stock is in an. The price of a stock fluctuates over a period of 10 days. On days 7 15 and 18 C.

Help Technical Analysis Moving Averages

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-02-be0cc8d6ba9243e5b20613a9fcec155d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-7559aba839cc410d8553868da1f1afc3.jpg)

Comments

Post a Comment